The City of Rome’s Downtown Development Authority (DDA) is pleased to announce the launch of “Banking on Downtown”, a local loan program established in partnership with Rome area banks to encourage the continued economic development of the downtown corridor.

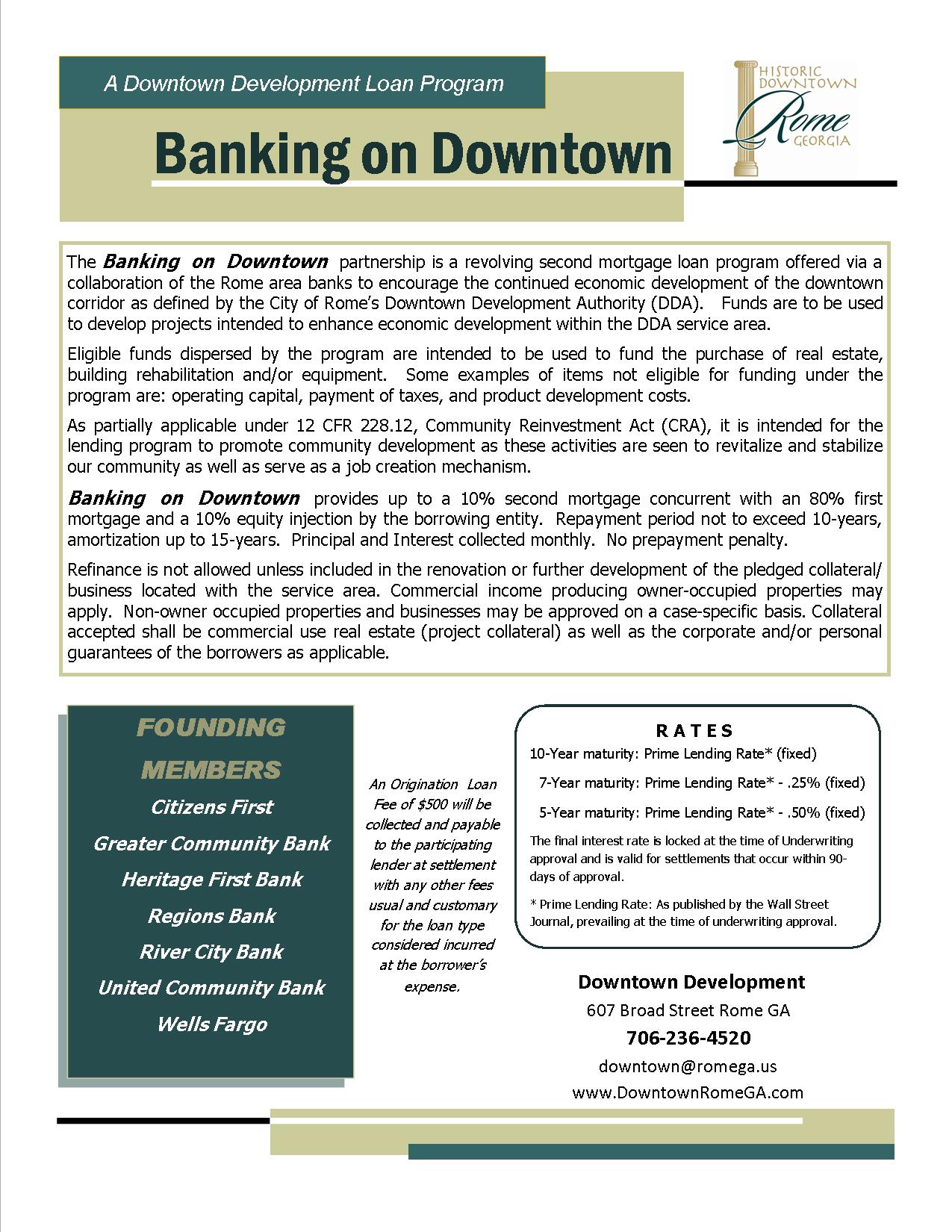

The new programs establishes a low-interest revolving loan pool to make second mortgage loan funds available for development projects within the DDA service area. Eligible funds dispersed by the program are intended to be used to fund the purchase of real estate, building rehabilitation and/or equipment. Operating capital, payment of taxes, and product development costs are examples of items not eligible for funding under the program.

Participating bank partners and founding members of the “Banking on Downtown” loan program include: Citizens First, Greater Rome Bank, Heritage First Bank, Regions Bank, River City Bank, United Community, and Wells Fargo.

“Much of the renovation work that has been completed in downtown to spur economic development has been financed with help from low interest rate loans,” said DDA Executive Director, Ann Arnold.

In the past 15 years, Rome businesses have received $4,492,318 in loans from the Georgia Department of Community Affairs (DCA) Revolving Loan Fund and $3,356,900 in Georgia Cities Foundation (GCF) loans. The GCF and DCA programs limit loans in any given city to 15 percent of their statewide portfolio; the City of Rome reached its funding limit at the end of 2015.

The lending program promotes community development through revitalization and stabilization, which also serves to promote job creation.

“Banking on Downtown” provides up to a 10% second mortgage concurrent with an 80% first mortgage and a 10% equity injection by the borrowing entity.

Businesses and entrepreneurs interested in applying for a “Banking on Downtown” loan should contact Downtown Development at 706-236-4520, located at 607 Broad Street, Rome, Georgia, 30161.